Blog > First-Time Home Buyer Mistakes (and How to Avoid Them)

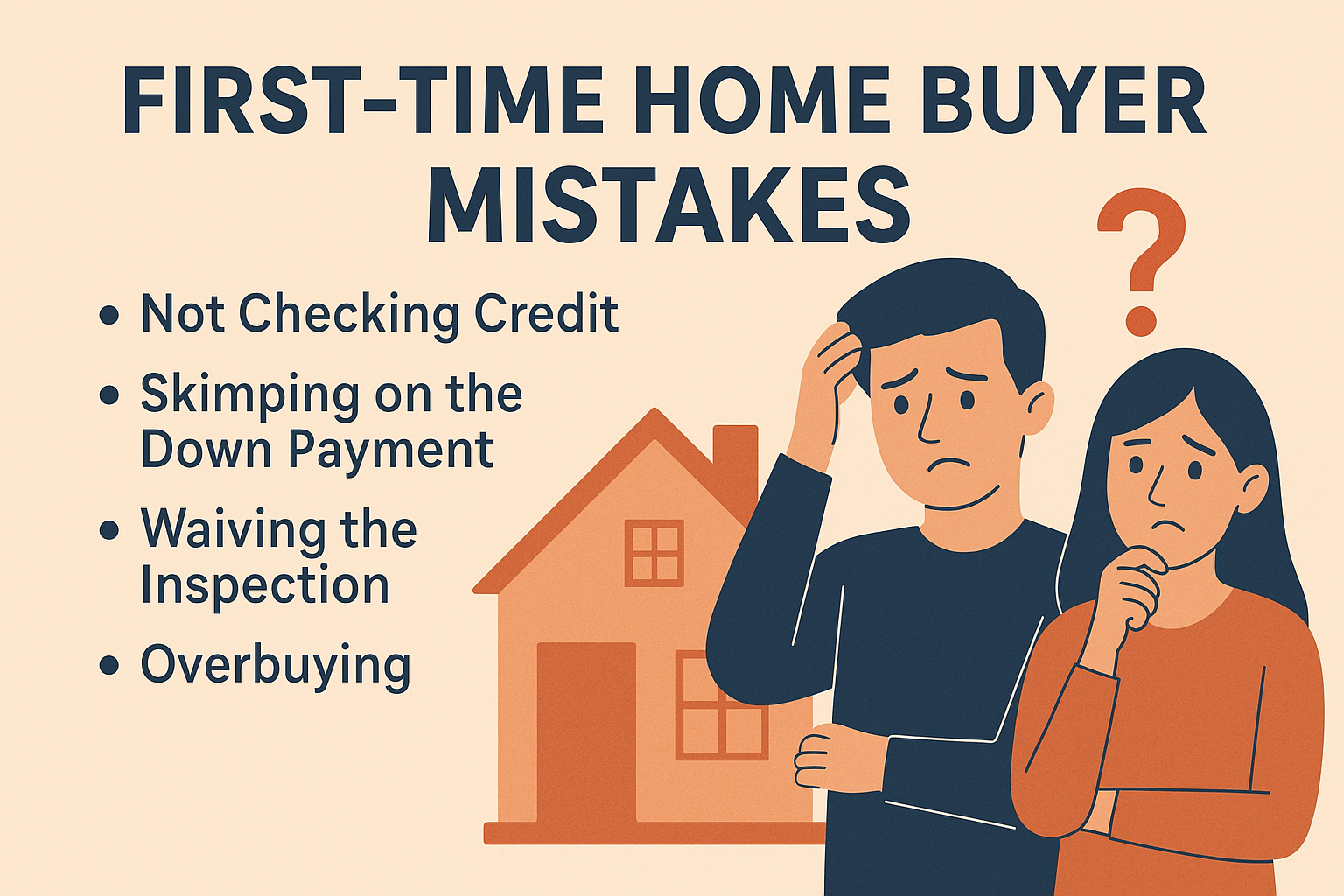

Buying a house for the first time is one of life’s most exciting—and nerve-wracking—milestones. Whether you’re looking to settle in Northern Kentucky, Greater Cincinnati, or a cozy suburb like Walton, Union, Florence, or Hebron, it’s easy to get swept up in the possibilities. But before you pick out paint colors, let’s talk about some common home buying mistakes that can trip up even the savviest first-time buyers—and, more importantly, how to avoid them.

Buying a house for the first time is one of life’s most exciting—and nerve-wracking—milestones. Whether you’re looking to settle in Northern Kentucky, Greater Cincinnati, or a cozy suburb like Walton, Union, Florence, or Hebron, it’s easy to get swept up in the possibilities. But before you pick out paint colors, let’s talk about some common home buying mistakes that can trip up even the savviest first-time buyers—and, more importantly, how to avoid them.

1. Skipping Pre-Approval: Why It Matters

One of the biggest mistakes first time home buyers make is house hunting before getting pre-approved for a mortgage. Without this crucial step, you might fall in love with a home that’s outside your budget or miss out on a deal while waiting for paperwork. Getting pre-approved gives you a clear picture of what you can afford and shows sellers you’re a serious contender.

2. Underestimating All the Costs

Many first time buyers focus on the down payment, but forget about closing costs, property taxes, insurance, and ongoing maintenance. For example, if you’re buying a home in Northern Kentucky, expect closing costs to range from 2% to 5% of the purchase price. Be sure to budget for everything—not just the sticker price!

3. Not Knowing Your Credit Score

Your credit score plays a huge role in the home buying process. Wondering what credit score you need to buy a house in Kentucky? Generally, a score of 620 or higher will qualify you for most conventional loans, but higher scores can unlock better rates. Check your credit early and address any issues before you start shopping.

4. Overlooking Local Programs and Assistance

Did you know there are special programs for first time home buyers in Cincinnati and Northern Kentucky? These can help with down payments, closing costs, or even offer lower interest rates. Don’t miss out—ask your agent about local options designed just for you.

5. Letting Emotions Lead the Way

It’s easy to fall for a home that “feels right,” but don’t let emotions cloud your judgment. Stick to your budget, and don’t waive important steps like inspections just to win a bidding war. Remember, buying a home is both a financial and emotional investment.

First Time Buyer Tips and Advice

- Research neighborhoods: Whether you’re considering Florence or Hebron, get to know the area’s schools, amenities, and commute times.

- Work with a local expert: A real estate agent familiar with the Greater Cincinnati and Northern Kentucky markets can guide you through the process and help you avoid costly pitfalls.

- Ask questions: No question is too small. Understanding the home buying process explained by a professional can ease your worries and build confidence.

FAQs for First Time Buyers

- How much down payment do first time buyers need in Ohio? Most buyers put down 3% to 5%, but there are programs that require even less.

- How to buy your first home with student loans? Lenders look at your debt-to-income ratio, so paying down other debts and having steady income helps.

Buying a home in Northern Kentucky or Cincinnati doesn’t have to be overwhelming. With the right preparation and a trusted guide, you can sidestep the most common mistakes and start your journey with confidence.